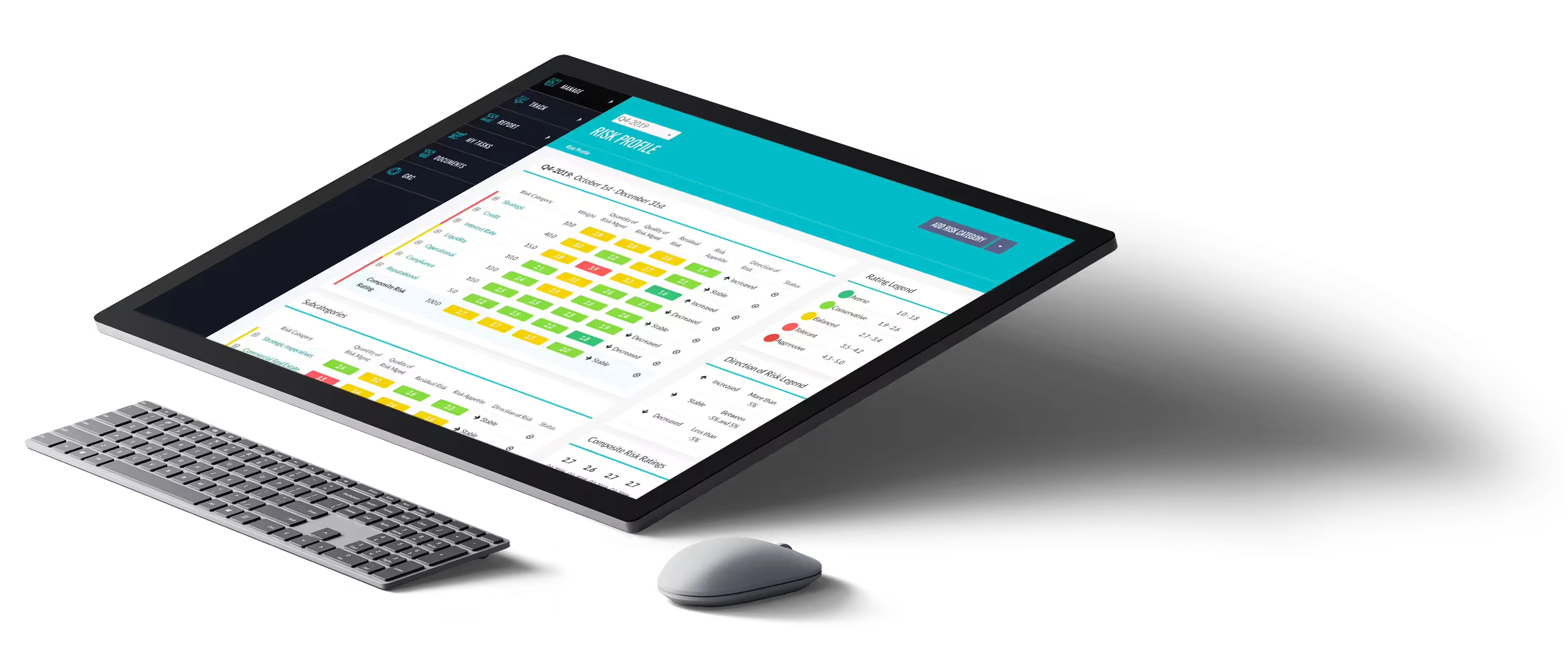

Our suite of proprietary technology solutions and methodologies were built “by bankers, for bankers” designed to help customers navigate risk and drive growth. Watchtower provides practitioners, executives and the Board with a panoramic view of risk to make informed decisions and drive performance.

Risk executives are on the line everyday to keep banks and financial institutions safe, sound and ready for growth. They count on SRA Watchtower to see problems before they become too big to solve.

.webp)

SRAis built to modernize the fulfillment of advanced risk management and strategic imperative performance for financial institutions. We are turning our vision into reality for our clients with state-of-the-art technology, deep experience, and clear and universal language so board of directors and specialized managers have the information they need to take positive action.

SRA’s software is patented and state-of-the-art, built by design for banks. SRA Watchtower seamlessly scales from young DiNovo banks to well-established multinational financial institutions. Our technology faithfully helps our clients fulfill their responsibility to their customers, colleagues, board members and shareholders.

The SRA leaders are hands-on practitioners from national banks, federal government regulators, state bank examiners and credit union executive teams. Our experience in banking, technology, data science, banking law, credit, risk, compliance, governance and finance make us an invaluable problem-solving team.

How well we communicate is determined not by how well we say things, but how well we are understood

How well we communicate is determined not by how well we say things, but how well we are understood

How well we communicate is determined not by how well we say things, but how well we are understood

SRA provides technology and advisory solutions exclusively to financial institutions in six critical domains

Board Reporting

Board Training

Governance Framework

Executive Reporting

Profitability

Growth

Planning

M & A

Management

Review & Stress Testing

Process Design

Policy Development

Loan Review

Market, Liquidity & IRR Risk

Capital Management

Capital Planning

Stress Testing

Compliance

Operations

Cyber Security

Legal & Regulatory

Fractional C-Level

Executive Coaching

Risk Training

Recruitment